Gst Registration-Individual

₹2,000.00 Original price was: ₹2,000.00.₹1,700.00Current price is: ₹1,700.00.

🌟 GST Registration for Individuals (FY 2024–25)

Goods and Services Tax (GST) is a unified tax applicable to goods and services across India. Individuals conducting business or providing services may require GST registration to comply with regulations, access tax benefits, and expand their business reach.

🔑 When is GST Registration Mandatory for Individuals?

✅ Turnover Thresholds:

- Service Providers: Turnover exceeding ₹20 lakhs annually (₹10 lakhs for special category states).

- Goods Suppliers: Turnover exceeding ₹40 lakhs annually (₹20 lakhs for special category states).

✅ Mandatory Registration Regardless of Turnover:

- Interstate supply of goods or services.

- E-commerce operations.

- Applicability of the reverse charge mechanism.

✅ Voluntary Registration:

- Individuals can opt for voluntary GST registration to avail Input Tax Credit (ITC) and issue GST-compliant invoices.

📜 Documents Required for GST Registration

| Document Type | Details |

|---|---|

| Identity Proof | PAN Card of the individual. |

| Address Proof | Aadhaar Card, Passport, Driving License, Voter ID, or Utility Bill. |

| Photograph | Passport-size photograph (JPEG format, maximum size 100 KB). |

| Bank Details | Canceled Cheque or Bank Statement. |

| Business Address Proof | Rent Agreement, Sale Deed, or Utility Bill of the business location. |

🚀 Steps for GST Registration for Individuals

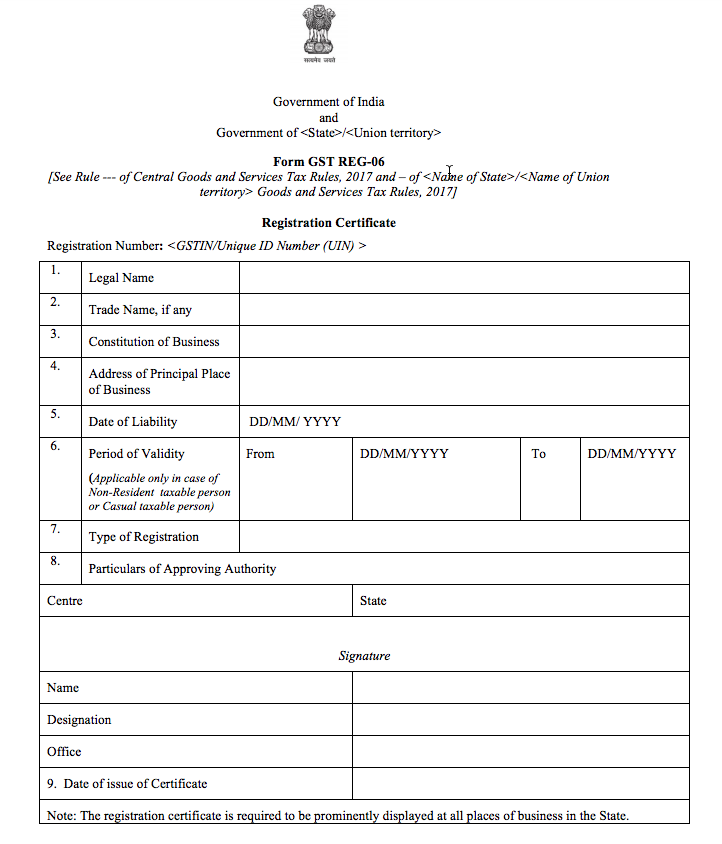

1️⃣ Prepare Documents: Gather PAN, Aadhaar, and business address proof. 2️⃣ Submit Online Application: Register on the GST portal and upload the required documents. 3️⃣ Verification Process: GST officials verify the application details. 4️⃣ Receive GSTIN: Upon approval, a GST Identification Number (GSTIN) is issued.

📊 Benefits of GST Registration for Individuals

✅ Tax Compliance: Stay compliant with GST regulations to avoid penalties. ✅ Input Tax Credit (ITC): Offset GST paid on purchases against your tax liability. ✅ Expand Market Reach: Sell through e-commerce platforms like Amazon, Flipkart, or Swiggy. ✅ Bank Loans: GST records act as proof of business activity, helping secure loans. ✅ Business Growth: Enhance credibility and trust with GST-compliant invoices.

📚 FAQs About GST Registration for Individuals

💬 1. Can I register for GST voluntarily? Yes, individuals can register voluntarily to claim ITC and enhance business credibility.

💬 2. Is GST registration mandatory for freelancers? Yes, if turnover exceeds the threshold or if services are provided interstate.

💬 3. How long does GST registration take? Typically, GSTIN is issued within 3 working days of application submission and verification.

💬 4. What if I don’t register for GST when required? Non-compliance results in penalties of ₹10,000 or 10% of the tax due, whichever is higher.

💬 5. Can I amend my GST registration details later? Yes, changes can be made online through the GST portal.

⚠️ Penalties for Non-Compliance

- Failure to Register: ₹10,000 or 10% of the tax due.

- Loss of ITC: Unregistered individuals cannot claim input tax credit.

📩 Contact Us Today!

📧 Email Us: info.autobiznow@gmail.com 📱 WhatsApp Business: 9871297057

🎯 Let AutoBizNow assist you with hassle-free GST registration, ensuring compliance and growth for your individual business!

AutoBizNow – Simplify. Transform. Grow.