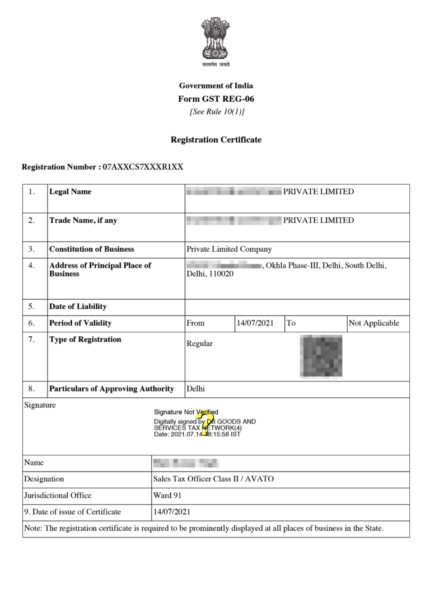

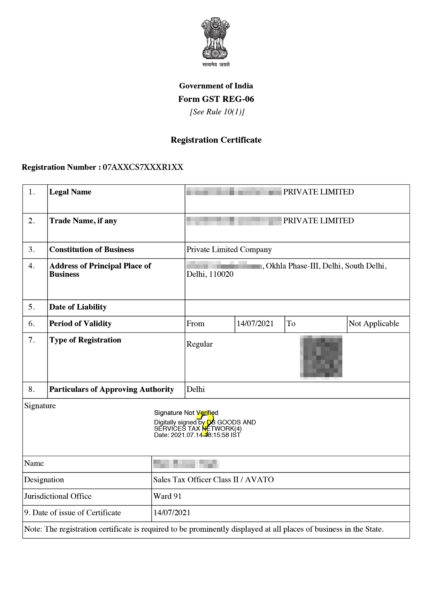

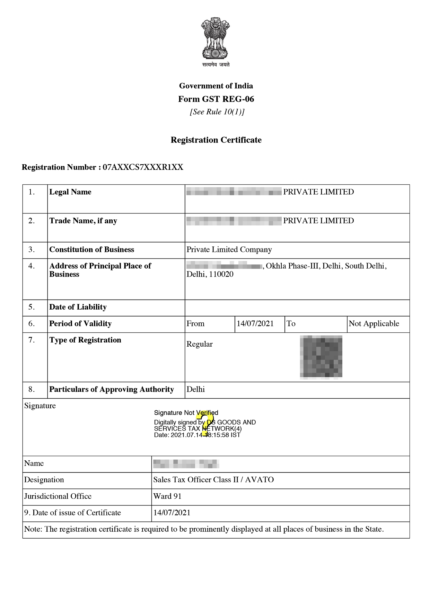

Gst Registration-Individual

Benefits of GST Registration

The following are some of the advantages of GST registration:

Bank Loans: GST registration and GST return filing serve as proof of business activity and create track record for a business. Banks and NBFCs lend to businesses based on GST return data. Hence, GST registration can help you formalize your business and get credit. Supplier Onboarding: To become a supplier of reputed companies, GST registration is often times a must during the supplier onboarding process. Hence, GST registration can help you get more business. eCommerce: GST registration is a must to sell online and through various platforms like Amazon, Flipkart, Snapdeal, Zomato, Swiggy, etc., Hence, having a GST registration will allow you to sell online.Input Tax Credit: Entities having GST registration are eligible to collect GST from customer for the supply and offset the liability against GST taxes paid while purchasing various goods and services. Hence, GST registration can help you save on taxes and improve margins.

Terms & Conditions

- Your Email-id and Mobile Number should be registered at Income Tax Department Portal

- Your Aadhar Card should be linked with mobile.